PE Investments Boost the Healthcare Sector in Egypt

Anna Lyudvig talks with Mediterrania Capital Partners' Daniel Viñas, Partner, and Khaled Saba, Egypt Senior Country Advisor.

Anna Lyudvig talks with Mediterrania Capital Partners' Daniel Viñas, Partner, and Khaled Saba, Egypt Senior Country Advisor.

In July, Vantage Capital, Africa’s largest mezzanine fund manager, has announced the successful first close on its fourth mezzanine fund. AGF’s Anna Lyudvig caught up with Warren van der Merwe, Managing Partner to learn more about the fund, current trends and opportunities in mezzanine debt.

It is not a revelation that many African economies remain heavily reliant on commodities exports. But just how closely African frontier equities markets’ performance (in USD terms) generally correlates with the global level of commodities prices is somewhat surprising. That’s because the equity market indices of sub-Saharan African frontier markets are completely dominated by domestically focussed sectors, such as financials and telecoms.

Imara Asset Management is planning to launch a new long-only equity Imara Fintech Fund, which targets high quality companies with scale-able technology, low customer acquisition costs and have long and wide runways for growth. According to Lead PM, Tony Schroenn, Imara started to pivot towards FinTech at the end of 2019. “We saw how beneficial it was, and how well it was working, we did a further pivot in 2020,” he recalls.

AGF speaks with Llewellyn Ford (pictured), Head: Investor Services, South Africa; Adam Bateman (AB), Head: Business Development, Investor Services; and Hari Chaitanya (HC) Head: Investor Services Product Management, Standard Bank, about African asset servicing industry, tech innovation and Standard Bank’s services

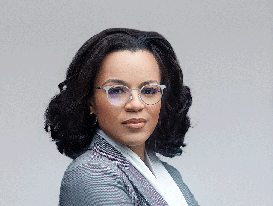

AGF’s Anna Lyudvig speaks with Angela Miller-May, CIO of the Chicago Teachers’ Pension Fund, about the Fund, investments opportunities in Africa and private equity

Mr. Market has spoken, and inflation is on the way. From Bank of America, this found its way into this contributor’s inbox recently: “US 5-year, 5-year forward inflation swaps [i.e., the price rises investors expect from 2026 to 2031] are pricing inflation consistent with the highest we have seen the past five years. This is not about base effects given last year's weakness, not about anything temporary”.

On the occasion of the Africa Financial Industry Summit, Anna Lyudvig spoke with Thapelo Tsheple, CEO of Botswana Stock Exchange to discuss investment products, IPOs and why Botswana is an ideal destination for investment.

Kingsley Williams, Chief Investment Officer of Satrix, looks into whether South Africa has been left behind in the global adoption of indexation

In March, RisCura launched a series of impact fund of funds – the first of its kind in South Africa. According to Malcolm Fair, Managing Director, RisCura, there is a global shift in the way investors think about their investments - they want more accountability and are increasingly moving towards purpose-driven investment where they can make a positive impact through their assets.

In February, Africa Finance Corporation, one of the biggest investors in infrastructure solutions in Africa, appointed new Executive Director and Chief Investment Officer, Sameh Shenouda. AGF’s Anna Lyudvig speaks with Mr. Shenouda about his investment philosophy, experience, infrastructure trends and more

The Cape to Cairo Road was an idea, birthed in the 1890s by British imperialists, for a pan-African highway, stretching from Cape Town in South Africa to Cairo in Egypt. The N1 in South Africa forms the first section of this now famous project and runs from Cape Town to Beit Bridge at the border of South Africa and Zimbabwe. In his February 2020 State of the Nation Address (SONA), President Cyril Ramaphosa acknowledged the role of infrastructure investment, including the rehabilitation of the N1, N2 and N3 highways, in helping dig the country out of its economic malaise. And he is right!

AGF’s Anna Lyudvig speaks with Tariye Gbadegesin, Managing Director & Chief Investment Officer at ARM-Harith about the current state of African infrastructure, the drivers of successful investing in Africa and more. With over 20 years’ experience, Tariye has mobilized over $3bn of capital for infrastructure projects in Africa. Tariye sits on the Millennium Challenge Council’s Advisory Board and is on the Advisory Committee on Infrastructure to the United Nations Principles for Responsible Investment.