Fear in SA bond market presents opportunities for investors

Word count: 431

Following the release of inflation data in May, the South African Reserve Bank indicated that there is room for interest rate cuts as the inflation rate circles 4.5%.

Following the release of inflation data in May, the South African Reserve Bank indicated that there is room for interest rate cuts as the inflation rate circles 4.5%.

As a result, markets now expect interest rate cuts of close to 0.5% over the next six to twelve months.

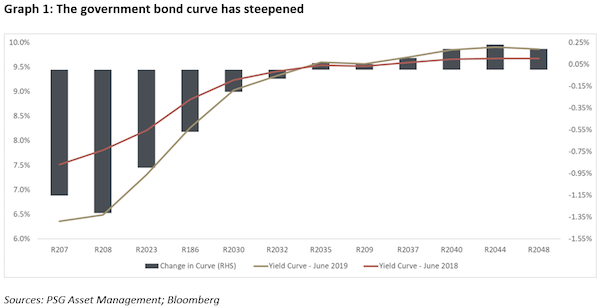

But if rate cuts are anticipated, why has the government bond curve steepened, with shorter-term rates falling but longer-term rates rising?

“Historically, rates have tended to fall across the bond curve in the months ahead of anticipated interest rate cuts,” said Lyle Sankar, Fund Manager at PSG Asset Management.

“Historically, rates have tended to fall across the bond curve in the months ahead of anticipated interest rate cuts,” said Lyle Sankar, Fund Manager at PSG Asset Management.

“Yet in this case, the government bond curve has steepened and yields on longer-term bonds have become more compelling.”

He added that this indicates fear in the market, as investors require greater incentive to invest in longer-term bonds.

“Bonds with maturities of more than five years remain out of favour due to concerns about sovereign risks. However, we believe that current fears are overdone and heightened by emotion.

“With longer-term rates of close to 10% – implying real yields of around 5% – we have increased conviction in these securities, as we do not believe that the steepness of the yield curve reflects the low-inflation environment,” said Sankar.

In fact, PSG Asset Management believes that longer-term bonds offer a healthy margin of safety that compensates for associated risks.

“Yes, there has been recent noise about possible changes to the SARB’s mandate of inflation targeting and protecting the value of the rand. However, it is important to remember that this mandate is constitutionally enshrined, and that any changes would require a change to the constitution,” said Sankar.

“Perhaps a more significant concern is that the noise implies a level of factional infighting within the ruling party, which could slow the pace of reform required to lift South Africa from economic stagnation.”

He noted that these are risks PSG Asset Management is monitoring closely, but which they believe are more than compensated for by the SARB’s track record and the real yields on offer from longer-term bonds. “In fact, these yields are higher than in several peer countries that have been lowered below junk status,” says Sankar.

“Being underwritten by a reserve bank that is intent on lowering inflation expectations provides further comfort,” he added.

“We believe that the odds of bond yields returning to more normal levels and delivering equity-like returns are in our clients’ favour. As always, it is important to filter out the noise and fear, and recognise the opportunities these present.”